Payday Loans Uncovered: What You Need to Know Before Borrowing

Payday loans are a short-term borrowing option designed to help individuals cover immediate expenses until their next paycheck. While they may seem like a quick and easy solution to financial difficulties, it's crucial to understand the implications of using such loans before committing. This article will provide an in-depth exploration of payday loans, how they work, their risks, and alternatives that may suit your financial needs better.

By arming yourself with information, you can make informed decisions about whether to pursue payday loans or seek out alternative financial options.

What Are Payday Loans?

Payday loans are short-term loans that allow borrowers to access a small amount of money, typically between $100 and $1,000, before their next paycheck. These loans are often marketed as a quick solution to unexpected expenses, such as medical bills or car repairs. However, they come with high fees and interest rates, making them an expensive option for those who need immediate cash.

The functionality of payday loans varies by lender; however, the basic premise is that you provide the lender with a post-dated check or access to your bank account in exchange for cash. Once your payday arrives, the lender deducts the loan amount, plus fees and interest, directly from your account.

How Do Payday Loans Work?

To secure a payday loan, you typically fill out an application online or in-person at a lending store. You’ll need to provide personal information, including proof of employment, income, and banking details. Verification of this information usually occurs quickly, enabling you to receive the funds in a matter of hours or even minutes in some cases.

Payday loans are generally designed to be repaid within a short period, usually on your next payday. However, due to the high cost of borrowing, many individuals find it difficult to repay the loan in full by the due date. This situation can lead to borrowing additional funds to cover the repayment, resulting in a cycle of debt that is challenging to escape.

Clarity in the repayment terms is critical. The total amount you owe when the loan comes due must include the principal, fees, and interest. If you cannot repay the loan when it is due, lenders often provide the option to extend or refinance it, which can increase your overall debt burden significantly.

The Appeal of Payday Loans

The primary appeal of payday loans is their accessibility. Since they often don't require a credit check, many individuals with poor or no credit history are able to secure funds quickly. This easy access can be appealing to those who find themselves in financial emergencies and require immediate assistance. Furthermore, payday loans have minimal documentation requirements, making them a convenient solution for urgent cash needs.

The Risks Involved

Despite their convenience, payday loans carry substantial risks. The first risk is the high cost of borrowing, which can lead you into a cycle of borrowing and debt. When the loan amount is repaid, many borrowers find themselves still struggling financially, often leading them to take out another payday loan just to cover the previous debt and their ongoing expenses.

Additionally, payday loans can negatively impact your financial wellbeing. If a repayment fails, or if a borrower does not have sufficient funds in their account, they may incur overdraft fees from their bank, which exacerbate their financial difficulties even further.

- Sky-high interest rates that can exceed 400% annually

- Potential to enter a debt cycle, where you continually borrow to repay existing loans

- Risk of penalties or fees for missed payments

- Possibility of legal action if debts go unpaid

- Impact on your bank account due to overdraft fees

Considering these risks is paramount before deciding to take on payday loans. Understanding your ability to repay without jeopardizing your financial stability will help inform your decision.

Costly Fees and Interest Rates

One significant drawback of payday loans is the exorbitant fees and interest rates they carry. The interest on these loans can be extremely high, which can make even a small loan amount significantly more expensive by the time it comes due. Many lenders charge a flat fee for borrowing, which can range from $15 to $30 per each $100 borrowed, leading to an annual percentage rate (APR) that can be staggering.

The combination of principal and fees creates a scenario where borrowers can end up paying back much more than they originally borrowed. The cost of payday loans can add up quickly, creating unnecessary financial strain.

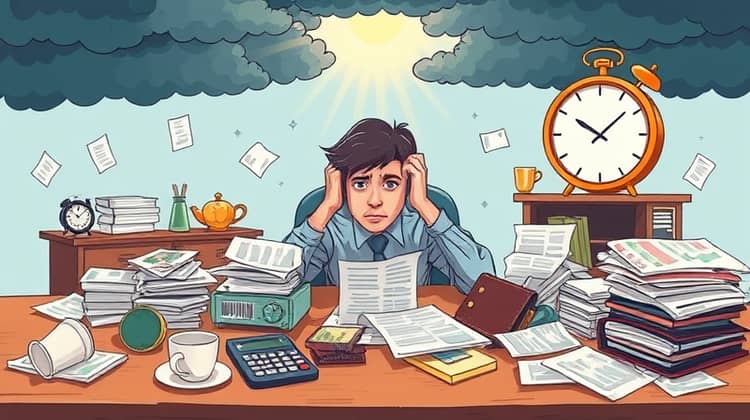

The Debt Cycle

One of the most concerning aspects of payday loans is their potential to trap individuals in a perpetual cycle of debt. Many borrowers find themselves consistently borrowing again and again because they cannot afford to pay off the original loan, leading to exponentially increasing debt. This cycle creates a harmful financial situation, often resulting in a deepening financial crisis.

In many cases, borrowers may apply for multiple loans from different lenders, compounding their debt and severely affecting their financial health. Breaking free from this cycle often requires considerable financial planning and behavioral changes, which can be challenging for those already under financial strain.

Impact on Credit Scores

While payday loans do not directly affect your credit score since they often do not require credit checks, failing to repay them can have severe consequences. If a loan goes unpaid and it is sent to collections, this will be reported to credit bureaus, resulting in a decrease in your credit score. Having a low credit score can hinder your ability to obtain other forms of credit in the future.

Moreover, the negative impact on credit scores can contribute to a cycle where borrowers are forced to rely on payday loans even more due to their inability to qualify for traditional loans with better terms and lower interest rates.

Limited Regulation

Payday loans are subject to limited regulation in many jurisdictions. This lack of oversight means that lenders can impose extravagant fees and interest rates without the restrictions seen in traditional lending practices. The variations in regulations can create environments that allow predatory lending practices to flourish, targeting vulnerable populations.

It is essential for individuals considering payday loans to be aware of the lending laws in their area, as they differ greatly. Understanding your rights as a borrower can help you navigate these waters more effectively and might provide options for recourse if things go wrong.

Alternatives to Payday Loans

Given the high costs and risks associated with payday loans, it is beneficial to explore alternatives that may offer better financial solutions. Many individuals find themselves in a situation where borrowing money is necessary; however, looking for more sustainable options can help avoid the pitfalls of payday lending. Here are a few alternatives worth considering:

- Credit unions offering small loans with lower interest rates

- Personal loans from traditional banks or online lenders

- Borrowing from friends or family with more favorable terms

- Payment plans with service providers, instead of immediate payment in full

- Side jobs or gig work to earn extra income quickly

Exploring these alternatives provides a more responsible approach to borrowing, reducing the risks and potential costs associated with payday loans.

Borrow From Friends or Family

If you find yourself in need of quick cash, consider reaching out to friends or family. Borrowing from loved ones often comes with more favorable terms and lower or no interest rates, making it a financially sound solution. It’s important to communicate openly about the details of the loan and your plan for repayment to maintain trust in the relationship.

While it may feel uncomfortable to ask for help, many people are willing to assist those in need, especially when they understand the circumstances. Establishing a repayment plan can also help ensure that you meet your obligations and sustain your relationships.

Personal Loans

Personal loans from banks or credit unions can serve as a more economical option for those in need of cash. These loans often come with lower interest rates and longer repayment terms than payday loans, providing a more manageable repayment schedule. Personal loans generally require a credit check, but individuals with fair credit can often still qualify for these loans.

By utilizing a personal loan, borrowers can meet their financial needs while minimizing the risks associated with payday loans. Prioritizing personal loans may help individuals escape the cycles of debt often seen with payday lending.

Credit Card Cash Advances

Another alternative to payday loans is taking a cash advance on your credit card. While this option may come with fees and potentially high-interest rates, it typically remains lower than those associated with payday loans. Before utilizing a cash advance, it’s essential to review the terms and conditions carefully to understand the full costs involved.

Using credit cards can help provide the necessary funds while allowing individuals to maintain greater control over their payments over time. However, it's crucial to avoid falling into the trap of carrying a balance that becomes unmanageable.

Negotiate With Creditors

If financial hardships arise, it might be worth considering negotiating payment plans with your creditors. Many companies are willing to work with individuals who reach out proactively to discuss their financial situations. By communicating openly, you may be able to lower payments, extend repayment terms, or even reduce interest rates.

Negotiating with creditors can create a manageable path forward while avoiding the necessity of high-interest loans. Establishing a clear agreement can alleviate some of the immediate financial stress.

Create a Budget

Developing a budget is one of the most effective ways to manage your finances and prevent the kinds of emergencies that lead to considering payday loans. By outlining your income and expenses, you can gain a clearer picture of your financial health and identify areas for potential savings.

Budgeting helps you allocate funds for essential expenses while ensuring you save for those unexpected costs that may arise. Creating a budget is not just about cutting costs but empowering yourself to make informed financial choices that prevent reliance on payday loans.

Tips for Avoiding Payday Loan Traps

To avoid falling into payday loan traps, it is vital to remain informed and proactive in managing your finances. Here are several tips to help steer clear of the pitfalls associated with payday lending:

1. Educate yourself about the terms and conditions of any loan agreement before signing. 2. Always explore multiple options and lenders to find the best deal. 3. Draw up a realistic repayment plan to avoid falling behind on payments. 4. Seek help from financial advisors or credit counseling services if needed. 5. Look into local community resources or solutions that provide assistance without high costs.

- Do thorough research on lenders and their practices before borrowing

- Consider your ability to repay before taking out any loan

- Prioritize building an emergency fund to reduce reliance on loans

- Engage family and friends in financial discussions for support

- Review and adjust your budget regularly

These tips can help provide a roadmap for managing financial challenges without resorting to payday loans. Making informed choices and staying aware of your financial situation are key to long-term financial health.

Conclusion

Payday loans may present an easy solution for immediate financial needs; however, they come with serious risks and long-term consequences that can undermine your financial stability. Understanding the costs, traps, and implications of payday borrowing is essential to making responsible financial choices. As individuals navigate their financial journeys, prioritizing alternatives and employing proactive strategies can lead to more sustainable financial outcomes.

Ultimately, relying on payday loans without a clear understanding of your financial obligations can lead to a cycle of debt that is hard to break. Awareness and education are pivotal in making decisions that protect and enhance your financial wellbeing.